Another American Freight Business Takes a Beating

Federal Express (FDX) is in the freight business and – just like United Parcel Service (UPS) last week – is being looked at by Wall Street as maybe just about as weak.

Federal Express (FDX) is in the freight business and – just like United Parcel Service (UPS) last week – is being looked at by Wall Street as maybe just about as weak.

The stock today tanked by 6.62% after being down by almost 8% in early trading. The big delivery company has a market cap of $60 billion and it’s an S&P 500 component.

The daily price chart shows just how bad the damage was today.

From the June 2024 high of $310 to the current $247 amounts to a loss of 20.32% for those who bought at the top and have held on through today.

Daily price chart

The stock in September and once again in November attempted to rally back to that June high but without success.

The last three trading sessions have taken the price to well below both the 50-day and the 200-day moving averages, a clear sign of weakness.

Today’s 6.62% drop breaks below the September low of $254 and the price is now testing the support levels from late June and July 2024 in that $240 to $250 area. A close below the summer low of $240 would be a significant breakdown unless buyers show up again in volume.

Although the 50-day moving average has not yet crossed below the 200-day moving average, it certainly appears as if that event is imminent. I would guess ‘next week’ unless some peculiar sort of heavy buying shows up from out of nowhere.

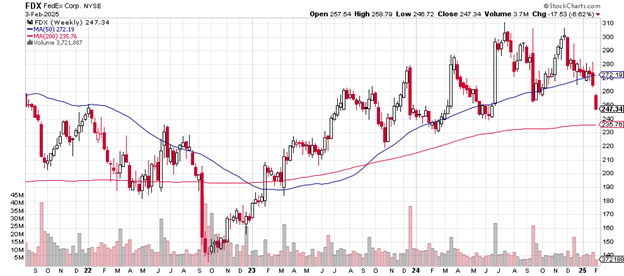

Here’s what the weekly price chart looks like.

Two straight closes below the 50-week moving average are not bullish.

The close below the September 2024 low price is clearly seen on this weekly chart. The stock is testing the upper portion of the June/July 2024 support area where buyers re-entered last time around.

Weekly price chart

The next significant level of support would be the October 2023 low of just under $220. A slide to that area would take the price below the 200-week moving average.

The 50-week moving average crossed above the 200-week moving average in September 2023 and remains above it even with the recent selling.

Today’s trading in Fed Ex and most other stocks was influenced by White House decisions to impose tariffs on Canada, Mexico, and China. This move had been somewhat priced in, of course, but the early-in-the-session sellers took it as new bad news.

Federal Express is owned in large numbers by more than just a few leading Wall Street investment houses: Blackrock, for example, has a 6.11% position, JP Morgan a 3.99%, and State Street a 3.85%.

The company pays a 2.20% dividend. The price-earnings ratio of 15 is much less than the Shiller p/e for the S&P 500, now at 37.81.

Charting the markets!

John Navin

Analyst, The Flash Report