Another Big Tech Stock Heading for 52-Week Low

Depending on which metric was analyzed, Adobe Systems reported 4th quarter results that either fell short of or failed to beat analysts' expectations.

Adobe Systems (ADBE) took a deep slide of 13.95%. That takes this Nasdaq-traded name-brand software application maker to a new 52-week low.

Depending on which metric was analyzed, Adobe Systems reported 4th quarter results that either fell short of or failed to beat analysts' expectations.

The Dow Jones U.S. Software Index dropped 2.33% Thursday, so you can estimate how poorly Adobe performed relative to others in the sector.

The daily price chart looks like this.

The stock has been down-trending for months now: the 50-day moving average crossed below the 200-day moving average in late October 2024 and has not crossed back above it since then.

Daily price chart

Note how much volume expanded for Thursday’s session. That’s 14.235 million shares traded versus average daily volume of 3.80 million. That’s an expansion of 3.77 times the usual amount, an indicator of the apparent “just get me out” sentiment.

The drop from the September high near $588 to the present $377.84 comes to a loss of 35.7% for investors who purchased at the top and continue to hold the shares.

The resistance level, should buyers return in numbers, might be the mid-February high near $465 which would take the price to above the 50-day moving average.

The huge gap down in early December from the $540 area to just above $490 might be a target for traders with eventual upside in mind, however unlikely that might seem for now.

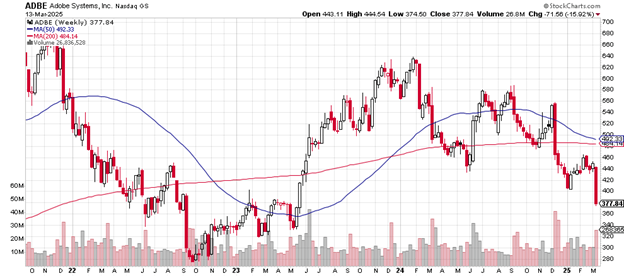

The weekly price chart looks like this.

The stock appears to have peaked in November 2021 near the $680 level and the re-test of January 2024 could only make it up to the $640 level before selling interrupted.

Weekly price chart

There have been more sellers than buyers, with occasional brief surges, since then and Thursday’s low keeps that bearish phenomenon in place.

Unless upward momentum appears soon, the 50-week moving average is set to cross below the 200-week moving average, signaling the likelihood of more weakness.

Should selling intensify, the next most likely support area might be the September/October 2022 lows.

Adobe Systems is market capitalized at $164.32 billion. The stock is a member of the S&P 500 as well as the Nasdaq 100 and two or three software ETFs. The price-earnings ratio is 30.45. The debt-to-equity ratio is 0.50.

BMO Capital Markets today “reiterated” its “outperform” rating for the stock with a price target of $495. In early January, Deutsche Bank downgraded Adobe Systems from “buy” to “hold” with a price target of $475.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.