Carvana’s PE is How Much!

Carvana offers quite a deal for those looking for a new ride online. No salesperson and you can have your vehicle delivered or pick it up at one of their ‘car vending machines.’

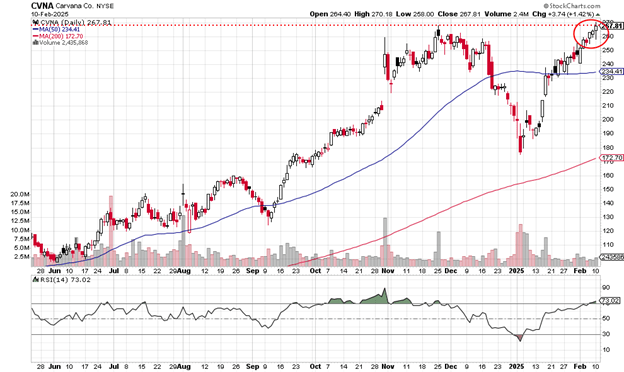

Car and truck dealership Carvana (CVNA), hit a new high on Monday before pulling back slightly.

Carvana offers quite a deal for those looking for a new ride online. No salesperson and you can have your vehicle delivered or pick it up at one of their ‘car vending machines.’

Wall Street likes the stock enough to give it a price-earnings ratio of 32,309.

If that seems insanely high, go with the ‘forward p/e,’ which represents the price based on the expectations of analysts for the next 12 months (more or less): 95.37.

The Shiller p/e for the S&P 500 (the “inflation-adjusted” measure) is 37.96, provided for those who enjoy making comparisons.

The daily price chart is here.

Monday’s new closing high takes out the resistance (where sellers overcame buyers) from the late November 2024 high. Note that the price has remained above the 50-day moving average (the blue line) since mid-January 2025 without much difficulty.

Daily price chart

Carvana stock trades well above the 200-day moving average (the red line) and has done so for the entire period represented by this chart. This strong uptrend is viewed quite favorably by the crowd of investors known as “trend followers.”

The early January low of just under $180 is a likely support level should any kind of serious sell-off develop. You can see that this price zone coincides with the level of the 200-day moving average.

Here’s the weekly price chart.

Monday’s new 12-month high remains below the September 2021 high which may now be a target for buyers. There are no guarantees, of course.

Weekly price chart

With the 50-week moving average crossing above the 200-week moving average in late November 2024, that’s a bullish signal for most analysts.

It would be more bullish if that 200-week moving average could turn from downward to upward. This price chart shows that it’s not there yet.

The long curve from down to up on the 50-day moving average from 2022 to 2024 is a positive look.

This year’s reported earnings of +106% make money managers happy and that’s one of the big reasons for the recent share purchases.

Carvana’s debt-to-equity ratio of 10.22 is on the high side for an NYSE-listed security and that could be a reason for the relatively high short ratio of 11.42%. As the price goes up, those with short positions are forced to cover, adding to the amount of buying already underway.

Citigroup analysts on Jan. 8, 2025, upgraded the stock from “neutral” to “buy” with a price target of $277.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.