Hot AI Stock a Buy Again?

Palantir Technologies, heavily involved in AI applications, is among the handful of names immediately mentioned by analysts looking for exposure to that sector.

Palantir Technologies (PLTR), the data mining software company, made a gain on Wednesday of 6.79%. It’s one of the most actively traded stocks almost every day.

Palantir Technologies, heavily involved in AI applications, is among the handful of names immediately mentioned by analysts looking for exposure to that sector.

CEO Alex Karp – who co-founded the company with Peter Thiel and others – recently moved corporate headquarters to Denver from Palo Alto.

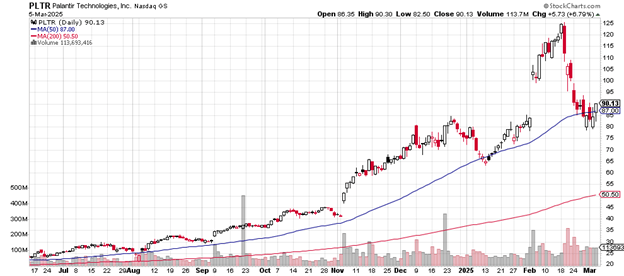

Here’s the daily price chart.

It’s a classic example of a hot stock on an amazingly bullish run-up – right up until mid-February 2025. The peak, near $125, did not last long as sellers returned with enough energy to take the price down to near $80 by the end of the month.

Daily price chart

After spending three closes below the 50-day moving average, Wednesday’s rally took the price back above it.

The session’s volume of 114.160 million shares is greater than average daily volume of 96.87 million shares. But that wasn’t enough from which to draw any significant conclusions.

Note how that huge early February gap up has been completely filled, almost as if those selling the stock had targeted that zone. Once filled, buy-the-dippers, trained by this year’s action, seem emboldened enough to re-enter.

If the unloading of shares returns, then a likely support area might be that early January 2025 level just below $65.

Also, the November 2024 gap up through the $45 zone is a likely support level should any heavy-duty dumping of shares unfold.

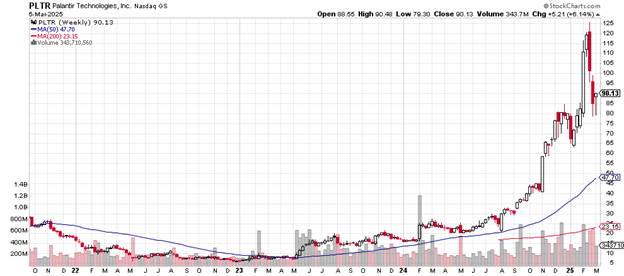

Here’s the weekly price chart.

From less than $10 in late 2022 to the present $90 is at least an 800% gain, the sort of return investors dream about. You can see why the stock has become so widely followed and actively traded.

Weekly price chart

The peak of near $125 is likely to become a resistance level, although with hot stocks like this, it’s hard to judge.

The first support level on this weekly chart is likely the January 2025 low of just below $65.

Should selling pick up and gather strength, the next level of support might be the uptrending 50-week moving average at $47.70.

Palantir Technologies has a market cap of $211.4 billion. The price-earnings ratio of 426 shows just how popular the growth stock has become. The p/e for the S&P 500 is 36.80, a historically high figure by itself.

Morgan Stanley in early February upgraded Palantir from “equal weight” to “overweight” with a price target of $95. William Blair on Wednesday upgraded it from “underperform“ to “market perform” with no price target mentioned.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.