Hot Stock Palantir Gets Even Hotter

Palantir has a history of gapping up after news and it’s become a favorite of the speculative crowd looking for quick gains. The price-earnings ratio of an extraordinarily high 521 is a testament to the hotness.

Palantir Technologies (PLTR), the software firm, beat earnings expectations and the already hot stock took off Tuesday morning, gapping up by more than 25% at the open of trading.

Palantir has a history of gapping up after news and it’s become a favorite of the speculative crowd looking for quick gains. The price-earnings ratio of an extraordinarily high 521 is a testament to the hotness.

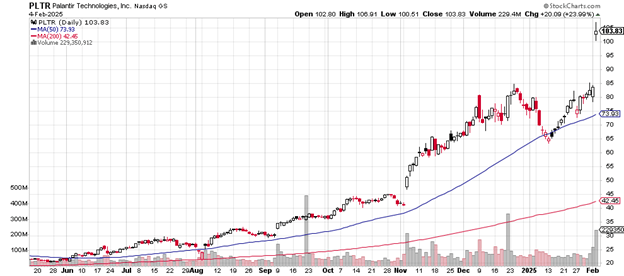

The daily price chart is here.

A 23.9% one-day gain on a major tech stock is something you don’t see that often. Palantir’s market capitalization is $236 billion so it’s not a small cap.

Daily price chart

If you look closely at the chart, you can make out the three previous gap-ups: in early August after that big sell-off, in early September, and in early November.

Strategists at hedge funds (and money managers elsewhere) now position for the phenomenon ahead of time and thus pump up the price even further.

At some point, this type of positioning will become too obvious and stop working but we’re not there yet.

This isn’t to diminish Palantir’s great quarterly earnings report, just a heads up that up days of this magnitude aren’t guaranteed.

The other part of this is the increasing attractiveness of this tech name to traders who focus solely on the absolute hottest up-trending stocks without too much gauging of relative valuation.

Palantir now trades above its 50-day moving average and well above its 200-day moving average. Both of those measures are trending upward, making for a positive looking chart.

Average daily volume for the software maker is 84.62 million. Tuesday’s volume came to 229,679,361 million.

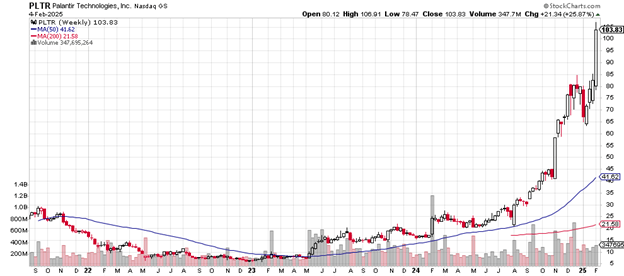

Here’s the weekly price chart.

From the early 2025 low of $64 to the present $103.83 amounts to a gain, from low to high, of 37.56%, not bad for a few weeks.

Weekly price chart

From the early 2025 low of $64 to the present $103.83 amounts to a gain, from low to high, of 37.6%, not bad for a few weeks.

That it’s so far above the 50-week moving average (headed up) speaks to the popularity on Wall Street to the stock.

Palantir Technologies hasn’t been around long enough for a 200-week moving average to exist until late July 2024. Since then, it has trended higher.

The software company lately emphasizes how much artificial intelligence is a factor in their products. Investors who look for AI-related stocks find Palantir early while conducting research.

Morgan Stanley on Tuesday morning upgraded their opinion of Palantir Technologies from ‘equal weight’ to ‘overweight’ with a price target of $95 – which I presume they will correct soon.

Palantir Technologies founder, the South African-born Peter Thiel, is a business associate of Tesla CEO Elon Musk, also a native of South Africa. Although the two have collaborated on a number of projects, their relationship is described as ‘complex.’

Charting the markets!

John Navin

Analyst, The Flash Report

Not investment advice. For educational purposes only.