Market Sell-Off Hitting This Stock Hard

Tuesday’s lower low takes out the August 2024 support level of $48, not a good sign for investors who hold the shares.

Chipotle Mexican Grill (CMG) closed on Tuesday down by 3.75% during a session when the Dow Jones Restaurant and Bars Index closed down by 1%.

In other words, the name-brand stock is underperforming – by far – the movements of the sector as a whole.

Tuesday’s lower low takes out the August 2024 support level of $48, not a good sign for investors who hold the shares.

The daily price chart is here.

Those who bought on the dip during the August 2024 sell-off – or those who purchased the stock thereafter – are no longer showing profits for the trade.

Daily price chart

Today’s volume of 17.96 million shares is much greater than the average daily volume of 11.11 million, a clear sign of investor belief in the downtrend.

The 50-day moving average in February crossed below the 200-day moving average, a heads-up for price chart analysts whether human or computer-programmed. Note that both measures are now moving in the down direction.

From the peak of the December 2024 high near $65 to Tuesday's closing price of $47.79 amounts to a loss of 26% in about three months.

One more thing about the daily chart: a head and shoulders pattern is present with the left shoulder near the October high, the head near the December high and the right shoulder near the late January high.

Such a formation is often considered bearish by technical analysts who notice such things.

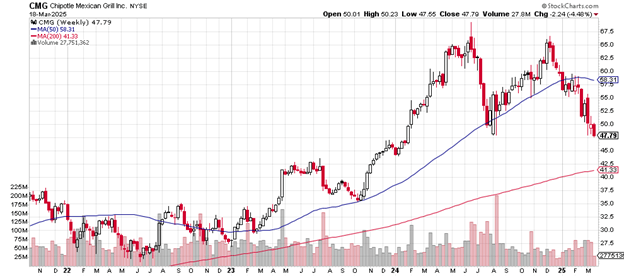

The weekly price chart is here.

The price shows a lower high and a lower low for the year 2024 to the present: this is the definition of a downtrend.

Weekly price chart

The November 2024 high came in under the level of the June 2024 high and this week’s new low came in under the July/August 2024 low prices.

That the 50-week moving average is now headed lower seems to be a confirmation of this.

The early 2024 low of just below $45 might be a support level if selling persists. Below that, should selling begin to pick up and continue, the October low near $35 looks like a possible support area (where buyers overcame sellers as the 50-week moving average began to head up again).

Chipotle Mexican Grill has a market cap of $64.77 billion. The stock is an S&P 500 component. The price-earnings ratio is 42.90. Earnings per share this year are up 15.67% and up over the past five years by 35.11%.

The company does not pay a dividend.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.