Real Estate Rebound Continues...

The uptrend is clear from the June 2024 low to the September 2024 high, and then the stock seemed to go sideways with ups and downs along the way. Friday’s close breaks out above that pattern.

Regency Centers (REG) is a real estate investment trust (REIT). It established a new high on Friday after consolidating price from mid-September 2024 to Thursday.

Greater volume than usual confirmed the move higher: average daily volume for Regency Centers is 1.02 million shares and during Friday’s session 1.88 million shares changed hands.

Headquartered in Jacksonville, Florida, the firm specializes in owning and developing retail properties.

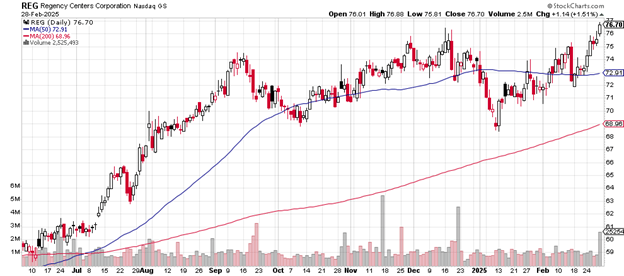

Here’s the daily price chart.

The uptrend is clear from the June 2024 low to the September 2024 high, and then the stock seemed to go sideways with ups and downs along the way. Friday’s close breaks out above that pattern.

Daily price chart

Volume increased on the day. Average daily volume for Regency Centers is 1.02 million shares. Friday’s volume was 1.88 million. The greyish bar along the bottom of the chart shows the significant volume growth for the new high session.

That slight upward move in the 50-day moving average may begin to move higher should the new high bring in investors who look for such moves in their purchases.

That the price now trades well above both significant moving averages – near-term and longer-term – is a bullish phenomenon.

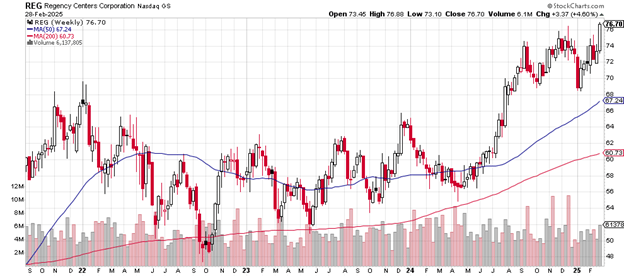

Here’s the weekly price chart.

Note how strongly both the shorter-term and the longer-term moving averages continue to move upward since early-to-mid 2024.

Weekly price chart

You can see how the 50-week moving average crossed above the 200-week moving average way back in August 2021 – and has managed to remain above it since then. This is a strong performance for the real estate investment trust.

That both moving averages have trended steadily higher is good news for shareholders.

The iShares U. S. Real Estate ETF (IYR) has failed to make a new high since late December 2024, so Regency Centers is one of the NYSE REITs now outperforming one of the sector benchmarks.

The trust is also outperforming the Real Estate Select Sector SPDR Fund (XLRE), another closely followed REIT benchmark which has failed to make a new high this year.

There are no guarantees, of course, that such outperformance will continue, but right now it’s impressive.

The market cap for Regency Centers is $14 billion. The price-to-earnings ratio is in line with that of the S&P 500’s at 36. The price-to-book value ratio is 2.13.

Deutsche Bank in September 2024 downgraded the REIT from “buy” to “hold” with a price target of $75. KeyBank Capital Markets initiated coverage in October 2024 with a rating of “overweight” and a price target of $80.

The REIT pays a dividend of 3.70%.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.