Strong Capital Growth and Now a Dividend Too...

A striking factor of this chart is the way the 50-day moving average has trended upward and remained above the 200-day moving average for all the months indicated.

Loews Corp’s (L) Thursday gain of 0.43% gain gives the stock a new closing high

A higher high than the late November 2024 apparent peak and the February 2025 peak (now also a former peak). Loews is a property and casualty insurance firm, with hotel, pipelines, and packaging properties – and a market cap of $18.77 billion.

It’s been a positive that the New York-based company recently announced it would begin paying a dividend.

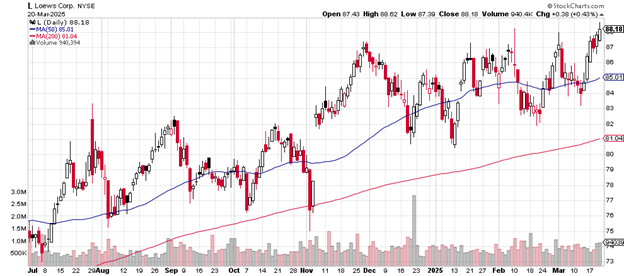

Here’s the daily price chart.

A striking factor of this chart is the way the 50-day moving average has trended upward and remained above the 200-day moving average for all the months indicated. That the 200-day trends upward without a significant dip is also quite a feature.

Daily price chart

Thursday’s volume of 940,449 shares exceeds average daily volume of 751,260, a notable expansion indicating strong buying appetite for the stock.

Should selling take over from buying, a likely support area might be the mid-March low just above $83.

More serious unloading of stock might test support in the $82 to $80 zone where lows were made in December 2024, January 2025, and February 2025.

The 200-day moving average is now in that zone with Thursday’s closing level of $81.04, possibly providing another supportive factor on any sell-off.

Note that the November 2024 gap up from just above $78 to near $82 remains unfilled and could prove to be a target on any few days of unrelenting selling.

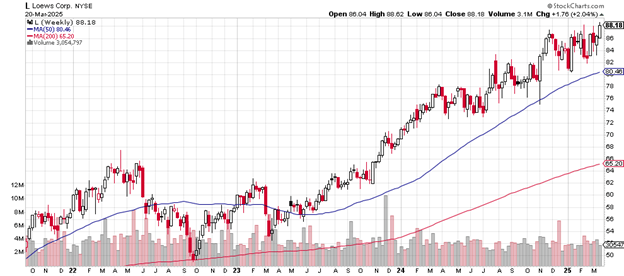

Here’s the weekly price chart.

From the October 2022 low of near $48 to this week’s $88.18 comes to a two-and-a-half-year gain of 83.7% for those fortunate enough to have purchased at the low.

Weekly price chart

The weekly chart is similar to the daily chart in that the 50-period moving average never drops below the 200-period moving average.

The most likely area of support if an unloading of shares takes place is the zone just below and just above $74 where the April to June 2024 lows came in.

Resistance is the Thursday high of $88.62.

Loews has a relatively low price-earnings ratio of 13. The stock trades at just 1.11 times its book value. Earnings over the past five years are up 15.85%. With these kinds of metrics, it’s almost a value stock of some kind.

At the beginning of this year, CEO James Tisch retired and VP Benjamin Tisch took over the new chief as leadership is kept within the family.

The new dividend will amount to a 0.28% yield.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.