The Dow's Worst Stock...

The month of February has been a tough one for the big drug manufacturer. The huge gap down on the second trading day came with the second biggest volume on the chart.

Merck (MRK) dropped to a new low at the opening of Tuesday’s trading and then buyers took it up a mere .06% by the close.

Investors are dealing with a quarterly report that recently disappointed and with the effects of the company’s decision to halt sales of the HPV vaccine Gardasil to China.

Merck is one of the 30 Dow Jones Industrials and an S&P 500 component. Its market capitalization is $219 billion.

The daily price chart looks like this.

The month of February has been a tough one for the big drug manufacturer. The huge gap down on the second trading day came with the second biggest volume on the chart.

That total volume came to just below 50 million shares. Merck’s average daily volume is about 13 million shares traded.

Daily price chart

Then, the next four sessions in a row ended in the red. It’s been a “just get me out” kind of time for many shareholders.

The 50-day moving average crossed below the 200-day moving average in September 2024 and has managed to stay below it since then.

The 200-day moving average began its downward turn in mid-October 2024.

The only other Dow stock with this kind of bearish tone is Nike (NKE) [See our previous analysis here]. The major tech and social media names are holding up much better than these two.

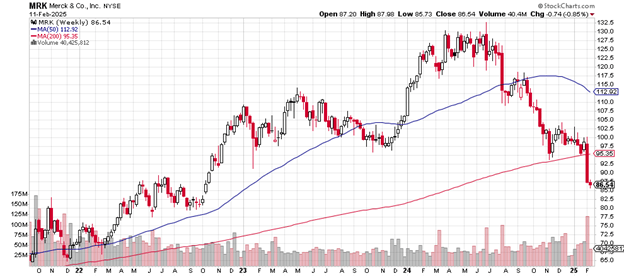

Here’s the weekly price chart.

It’s a serious price chart pattern: The stock has crossed below the 200-week moving average, not the sort of thing you see these days in a Dow 30 component. And we’re entering the second week of it.

Weekly price chart

Note that last week’s volume – the reddish bar underneath the price candlestick – is the biggest “selling” bar since late 2021.

That the 50-week moving average is trending downward is another bearish signal, It’s been headed that way since October/November 2024.

Support may lie at the $65 level, the late 2021 lows where buyers took over from sellers during the last down cycle for Merck.

Those who made purchases at the $132.50 peak in late June 2024 and who have held on until the current $86.54 are sitting with a 34.7% loss.

This year’s earnings are up by 17.5%. The past five years' worth of earnings are up by 12%.

The price-earnings ratio is 12.85. Merck’s dividend now comes to 3.8%.

Analysts at TD Cowen reduced their rating on the stock on Monday from “buy” to “hold” with a price target of $100.

It’s likely true as well that President Trump’s tariffs on China-produced goods may be affecting stocks that have done business with the Asian nation.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.