The Downtrending Stock That's Still in an Uptrend!

Although Honeywell is off by 0.41% by the close, note that this is the third straight day above the 200-day moving average which remains in an uptrend.

Honeywell International (HON) stock was down 0.41% on Monday, not bad considering the Dow Jones Industrials – of which Honeywell is a component – closed down 1.48%.

Outperforming the major index on a significantly off day is an achievement of sorts. Nevertheless, it remains an issue that the price continues in a downtrend and is now far, far away from the late 2024 peak price.

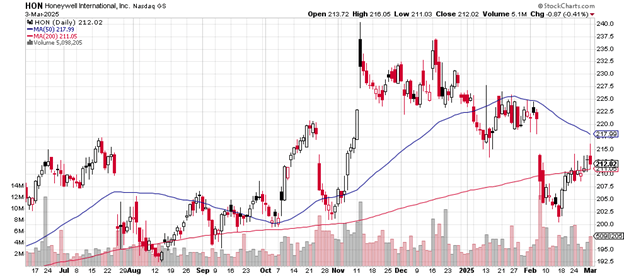

Here’s how the daily price chart looks.

The stock put in an early February 2025 low of near $200 and had rallied up to just above $215 during the session before retreating to $212. It didn’t quite fill the gap down that took place earlier in the month but came close.

Daily price chart

Monday’s volume of 5.1 million shares traded is above its average daily volume of 4.03 million shares, an indication of selling strength.

The 50-day moving average is just above the current price range and is trending downward. It would not be surprising to see a test of that level, although Monday’s expansion of selling volume perhaps makes this less likely.

Although Honeywell is off by 0.41% by the close, note that this is the third straight day above the 200-day moving average which remains in an uptrend.

If more selling comes in and the 200-day moving average level is violated, the next area of significant support is likely to come in at the August 2024 low near $192.50.

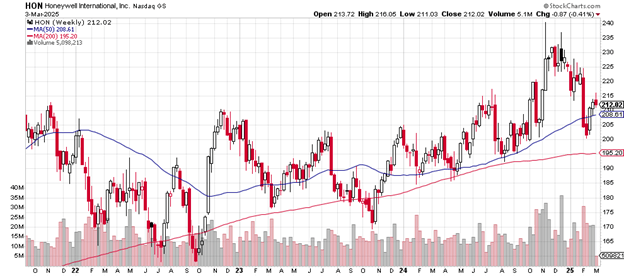

The weekly price chart is here.

The conglomerate now has three closes in a row above the 50-week moving average, a good sign for the bulls. Whether the price can break above the Monday high of above $215 remains the question.

Weekly price chart

It’s a positive that the 50-week moving average has managed to trade above the 200-week moving average for the duration of this chart. That the stock remains above it adds to the charm.

The January 2024 low near $185 might be support should any serious selling come back into the stock. Under that is likely support at the October 2023 low near $170 and then the September 2022 low of just under $160.

Honeywell is a huge company with a market capitalization of $137.80 billion. Besides the membership in the Dow Jones Industrials, the stock also is an S&P 500 and a Nasdaq 100 component. Thus, its price movements affect all the widely followed indexes.

The price-earnings ratio is 24.34 and debt-to-equity is 1.73.

Deutsche Bank on February 7th upgraded their opinion of the stock from “hold” to “buy” with a price target of $260.

Honeywell International pays a 2.15% dividend.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.