This Stock Has Bucked the Trend Among Falling Markets...

The gap up above the 200-day moving average is accompanied by a volume burst showing a sense of deep conviction among those taking the trade.

Crown Castle Inc. (CCI) was up 10.37% Friday after the firm announced it would sell its fiber optics business for $8.5 billion in a deal with Zayo’s EQT Infrastructure Fund and DigitalBridge Group (DBRG).

Crown Castle also announced a $3 billion stock buyback. The company said it expects to complete both moves during the first part of 2026.

Investors greeted the news with enthusiasm.

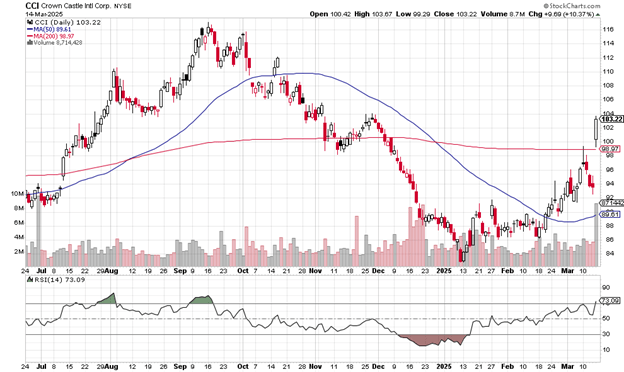

Here’s the daily price chart.

The gap up above the 200-day moving average is accompanied by a volume burst showing a sense of deep conviction among those taking the trade.

Daily price chart

The number of shares that exchanged hands on Friday was 8.7 million – that’s more than twice the average daily volume of 3.18 million.

The late November 2024 high of $104 is likely to be tested and investors will see just how strong the rally might be.

The September 2024 peak of just above $116 is the ultimate target for a move of this kind.

There is an unfilled gap down in mid-October 2024 from near $111 to near $110 and this may be another spot that may attract investors.

The 50-day moving average has turned upward as of late February/early March 2025 and price now trades well above it.

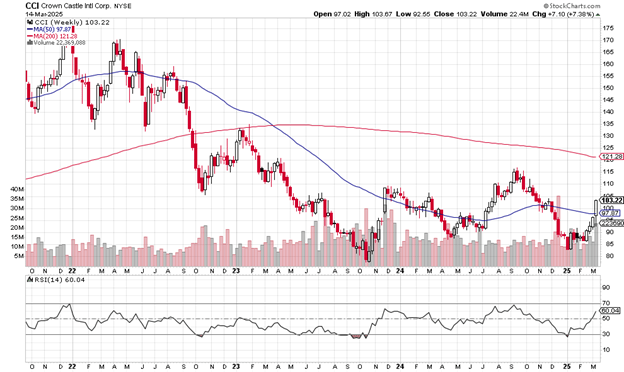

Here’s the weekly price chart.

Notice how strongly the price has risen above the 50-week moving average, quickly and on decent volume.

Weekly price chart

The up move may target that September 2024 high of just above $155 or, a bit higher than that. The area of the declining 200-day moving average now at $121.28. Algorithms programmed to notice these types of chart patterns are at work.

Another spot for resistance would be the January 2023 spike up to the $135 level, a burst of buying that failed to last long.

Shortly after that, the 50-week moving average crossed below the 200-week moving average indicating a longer-term negative change of mood.

Crown Castle International is a component of the S&P 500 and has a market cap of $44.86 billion.

This real estate investment trust is in the business of owning, operating and leasing the technology of shared communications infrastructure.

On Friday, these three investment firms upgraded their opinions of the company: UBS took it from “neutral” to “buy” with a price target of $118; Raymond James took it from “outperform” to “strong buy” with a $122 price target; and KeyBanc Capital Markets took it from “sector weight” to “overweight” with a price target of $120.

Crown Castle International pays a dividend of 5.76%.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.