"Trash" Stock Goes Higher and Higher...

Although many ups and downs exist on this chart, the main takeaway is “higher highs and high lows,” the definition of an uptrend.

Monday’s gain of 0.72% takes Waste Management (WM) to a new high, just barely but that still counts.

This S&P 500 component has a market capitalization of $92.4 billion. It’s also a member of the iShares Russell 1000 Growth ETF (IWF).

The company website says they’re “turning landfills into sustainable spaces that foster natural resources and enrich our communities.”

The Monday high price moves above the earlier-in-February high and above the late November 20024 high. New highs are a sign of continuing strength.

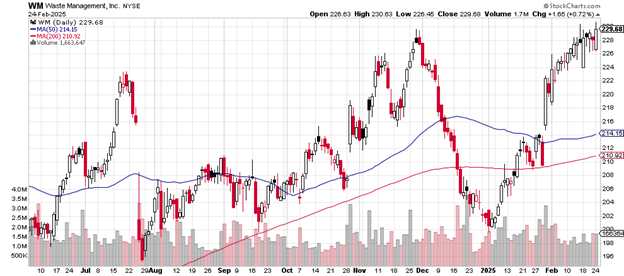

The daily price chart looks like this.

Daily price chart

Although many ups and downs exist on this chart, the main takeaway is “higher highs and high lows,” the definition of an uptrend.

Note how the 50-day moving average is beginning a turn upward and how it has never traded below the 200-day moving average on this chart.

The gain from the late December 2024 low of $200 to the present $229.68 amounts to a 14.8% increase over a very short period.

The 200-day moving average leveled out somewhat from mid-December 2024 to mid-January 2025 but has now resumed its clear upward trend again.

Because of the degree of the ups and downs, an investor must take into consideration the obvious volatility of such a stock despite the establishment of recent new highs.

The late January low of $209 would be a likely support area. If selling picked up, that $200 low from late December 2024 is the next likely support zone.

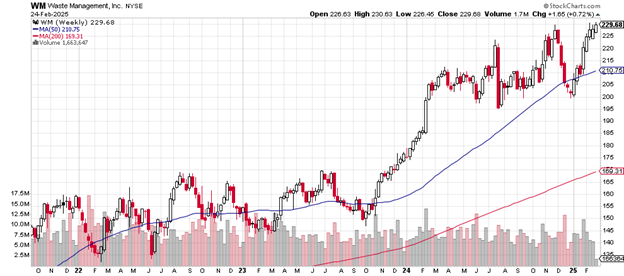

The weekly price chart is here.

Weekly price chart

The uptrend is strong and resilient over the years on this chart as the 50-week moving average remains above the 200-week moving average for the entire time.

The new weekly high comes as the fifth week in a row of gains and the seventh out of eight coming off the late December low near $200.

Both moving averages have been in relentless uptrends since late 2023 with prices strikingly well above the 200-week.

Waste Management trades with a price-earnings ratio of 33.74, just below the p/e for the S&P 500 taken as a whole. The company’s debt-to-equity ratio is on the high side at 3.02. Earnings this year are up by 5.58%. They’re up over the past five years by 11.75%.

Scotiabank in late January upgraded their opinion of the company from “sector perform” to “sector outperform” with a price target of $250.

Waste Management pays a 1.42% dividend.

Charting the markets!

John Navin

Analyst, The Flash Report

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

Not investment advice. For educational purposes only.