UPS Drops 14% – Likely More to Come...

The 14.1% drop today is a greater drop than any other S&P 500 component, not exactly a good look for any investor considering a purchase of shares.

United Parcel Service (UPS) lost 14.1% today as the company’s quarterly report beat expectations. But investors were surprised by the announcement that it would be reducing business with Amazon, its largest customer, by more than 50%.

UPS, a major shipping company and a component of the S&P 500 has a market cap of $95 billion.

Now let’s look at the chart.

The 14.1% drop today is a greater drop than any other S&P 500 component, not exactly a good look for any investor considering a purchase of shares.

The price slide takes UPS below both the 200-day moving average (the red line) and the 50-day moving average (the blue line), all in the same session.

Daily price chart

This kind of extreme slide is unusual for the type of globally recognized, brand-name stock represented by United Parcel Service.

Note how each high on the chart is lower than the previous high: July’s can’t make it up to the May level, the October rally comes in below the July high and the November high is lower than October’s.

An eight-month pattern of successfully lower highs indicates some underlying problem and today’s loss confirmed it on very heavy selling volume (the reddish bar under today’s red candlestick price).

Today’s low price of $110 comes just one day after the stock traded for $136: that’s a quick 19% down.

Note how this huge gap down took out the August low of $120 and kept going – no buying support showed up at that level, the selling was that intense. This was a ‘just sell the stock’ moment for UPS shareholders.

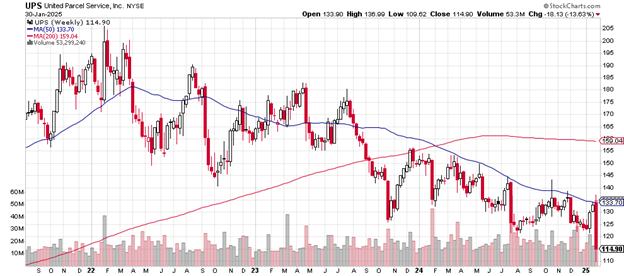

Here’s the weekly price chart. The price has been trending downward since the early 2022 peak of just above $205. You can see how the 50-week moving average begins to head steadily lower, month by month, from that point on.

Weekly price chart

It finally crossed below the 200-week moving average in early 2024, a signal for those who owned UPS to begin thinking about whether to continue to hold it.

The stock has traded underneath the 50-week moving average since August 2023 with just an occasional peak above it.

Average daily volume for the stock is 4.21 million – today’s volume was 41 million, almost 10 times the usual amount traded. That kind of price drop with that kind of volume is decisive.

The United Parcel Services dividend is now 5.73%. That may attract the attention of those seeking bigger-than-usual dividends in big-name stocks. The problem, of course, is how much cutting the Amazon business will affect earnings and whether the dividend can remain at that level.

Charting the markets!

John Navin

Analyst, The Flash Report